TRADEGATE Indikatoren

- Top 5 ausgef. Orders

- Top 5 Changes

- Titel des Tages

TRADEGATE - Top 5 ausgeführte Orders

|

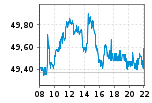

BASF SE

|

Gattung | Bid | Ask | ausgef. Orders | Change |

|---|---|---|---|---|---|

BASF SE  |

48,125 | 48,135 | 1 825 | -5,62% | |

Alphabet Inc. Class A  |

162,60 | 162,60 | 1 618 | +11,73% | |

Deutsche Bank AG  |

16,648 | 16,65 | 1 240 | -0,14% | |

Meta Platforms Inc.  |

415,80 | 416,05 | 1 238 | +1,08% | |

Microsoft Corp.  |

386,85 | 387,00 | 1 157 | +3,91% |

DAX®-Werte - Top 5 ausgeführte Orders

|

BASF SE

|

Gattung | Bid | Ask | ausgef. Orders | Change |

|---|---|---|---|---|---|

BASF SE  |

48,125 | 48,135 | 1 825 | -5,62% | |

Deutsche Bank AG  |

16,648 | 16,65 | 1 240 | -0,14% | |

Münchener Rückvers.-Ges. AG  |

410,30 | 410,50 | 753 | -2,96% | |

| Rheinmetall AG | 510,40 | 510,60 | 675 | -0,04% | |

Siemens Energy AG  |

18,29 | 18,295 | 603 | +2,67% |

MDAX®-Werte - Top 5 ausgeführte Orders

|

thyssenkrupp AG

|

Gattung | Bid | Ask | ausgef. Orders | Change |

|---|---|---|---|---|---|

thyssenkrupp AG  |

4,852 | 4,856 | 1 088 | +8,27% | |

Evotec SE  |

9,495 | 9,50 | 1 034 | +2,76% | |

Delivery Hero SE  |

28,08 | 28,10 | 717 | -10,40% | |

AIXTRON SE  |

22,70 | 22,73 | 385 | +2,59% | |

Deutsche Lufthansa AG  |

6,804 | 6,806 | 326 | +1,89% |

TecDAX®-Werte - Top 5 ausgeführte Orders

|

Evotec SE

|

Gattung | Bid | Ask | ausgef. Orders | Change |

|---|---|---|---|---|---|

Evotec SE  |

9,495 | 9,50 | 1 034 | +2,76% | |

AIXTRON SE  |

22,70 | 22,73 | 385 | +2,59% | |

Infineon Technologies AG  |

33,065 | 33,07 | 358 | +1,44% | |

Deutsche Telekom AG  |

21,67 | 21,68 | 350 | 0,00% | |

SAP SE  |

174,46 | 174,48 | 281 | +1,35% |

SDAX®-Werte - Top 5 ausgeführte Orders

|

flatexDEGIRO AG

|

Gattung | Bid | Ask | ausgef. Orders | Change |

|---|---|---|---|---|---|

| flatexDEGIRO AG | 11,955 | 11,975 | 809 | +15,40% | |

| Schaeffler AG VZ | 5,855 | 5,86 | 317 | -6,46% | |

| DWS Group GmbH & Co. KGaA | 40,36 | 40,40 | 143 | +1,35% | |

VARTA AG  |

9,25 | 9,28 | 140 | +3,12% | |

| TRATON SE | 35,70 | 35,80 | 136 | +5,92% |

EURO STOXX 50®-Werte - Top 5 ausgeführte Orders

|

BASF SE

|

Gattung | Bid | Ask | ausgef. Orders | Change |

|---|---|---|---|---|---|

BASF SE  |

48,125 | 48,135 | 1 825 | -5,62% | |

Münchener Rückvers.-Ges. AG  |

410,30 | 410,50 | 753 | -2,96% | |

Mercedes-Benz Group AG  |

74,17 | 74,18 | 471 | +1,08% | |

Allianz SE  |

263,40 | 263,50 | 470 | +0,08% | |

Bayer AG  |

27,42 | 27,425 | 428 | +1,59% |

TRADEGATE-US-Tec - Top 5 ausgeführte Orders

|

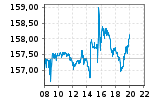

Alphabet Inc. Class A

|

Gattung | Bid | Ask | ausgef. Orders | Change |

|---|---|---|---|---|---|

Alphabet Inc. Class A  |

162,60 | 162,60 | 1 618 | +11,73% | |

Meta Platforms Inc.  |

415,80 | 416,05 | 1 238 | +1,08% | |

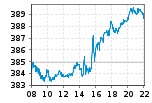

Microsoft Corp.  |

386,85 | 387,00 | 1 157 | +3,91% | |

Intel Corp.  |

30,22 | 30,285 | 1 032 | -7,66% | |

Nvidia Corp.  |

779,50 | 780,00 | 863 | +1,30% |

TRADEGATE-US-BlueChip - Top 5 ausgeführte Orders

|

Microsoft Corp.

|

Gattung | Bid | Ask | ausgef. Orders | Change |

|---|---|---|---|---|---|

Microsoft Corp.  |

386,85 | 387,00 | 1 157 | +3,91% | |

Intel Corp.  |

30,22 | 30,285 | 1 032 | -7,66% | |

Amazon.com Inc.  |

166,96 | 166,98 | 674 | +3,14% | |

Apple Inc.  |

158,50 | 158,52 | 277 | +0,04% | |

| Intl Business Machines Corp. | 157,76 | 158,00 | 123 | +0,34% |

sonstige Werte - Top 5 ausgeführte Orders

|

NEL ASA

|

Gattung | Bid | Ask | ausgef. Orders | Change |

|---|---|---|---|---|---|

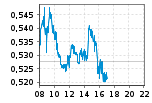

NEL ASA  |

0,4071 | 0,4089 | 636 | +4,95% | |

| BYD Co. Ltd. | 25,12 | 25,19 | 626 | +3,75% | |

| Xiaomi Corp. Cl.B | 2,0625 | 2,0695 | 514 | +4,39% | |

Alibaba Group Holding Ltd. sp.ADRs  |

71,40 | 71,50 | 288 | +1,85% | |

| Super Micro Computer Inc. | 743,40 | 745,80 | 281 | +1,61% |

Copyright © 2024 Tradegate Exchange GmbH

Bitte beachten Sie das Regelwerk

DAX®, MDAX®, TecDAX® und SDAX® sind eingetragene Markenzeichen der Quontigo Index GmbH

EURO STOXX®-Werte bezeichnet Werte der Marke „EURO STOXX“ der STOXX Limited und/oder ihrer Lizenzgeber

TRADEGATE® ist eine eingetragene Marke der Tradegate AG Wertpapierhandelsbank

Bitte beachten Sie das Regelwerk

DAX®, MDAX®, TecDAX® und SDAX® sind eingetragene Markenzeichen der Quontigo Index GmbH

EURO STOXX®-Werte bezeichnet Werte der Marke „EURO STOXX“ der STOXX Limited und/oder ihrer Lizenzgeber

TRADEGATE® ist eine eingetragene Marke der Tradegate AG Wertpapierhandelsbank

Kurse in EUR

Zeitangaben in CEST (UTC+2)

Top 5 Umsatz

Realtime Quotes

Letzte Aktualisierung:

26.04.2024 @ 11:43:35

Letzte Aktualisierung:

26.04.2024 @ 11:43:35